The 1997 debt crisis

Having looked at the way in which Japan

suffered strategic competitive defeat after 1973 we will now examine the

unfolding of the international debt crisis in 1997 in the South East Asian

economies.

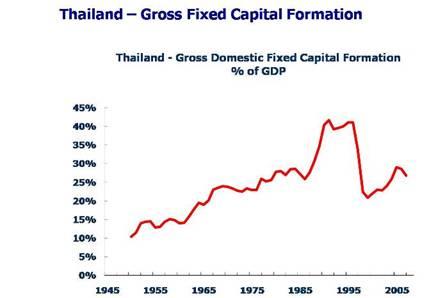

Slide 42 shows the percentage of GDP

devoted to investment in the country that was the initiator of the 1997 South

East Asian debt crisis - Thailand. Slide 43 shows Thailand’s GDP growth rate –

expressed as a five year moving average in order to eliminate the effect of

purely short term fluctuations. Note the fall in the percentage of GDP devoted

to fixed investment in Thailand after 1997. Note also the deceleration

in growth in slide 43. This is the same pattern as Japan after 1973, only of

course over a shorter timescale.

Slide 42

Slide 43

Slides 44 and 45 gives

the same data for South Korea. Note again the fall in the percentage of GDP

devoted to fixed investment in South Korea after 1997 and also the deceleration

in the growth rate. This is again the same pattern as Japan after 1973.

Slide 44

Slide 45

Slides 46 and 47 repeat the same data for

Singapore. Again note the decline in the percentage of Singapore’s GDP devoted

to investment after 1997 and also the deceleration of the growth rate. Again, the

same pattern as after Japan in 1973. Similar graphs could be given for

many South East Asian economies.

The effect of the 1997 debt crisis, the

‘second Asian financial crisis’, was therefore the same as the first. The level

of investment of the South East Asian economies was forced downwards, as

Japan’s had been after 1973, and their growth rates were reduced. This aided

the competitive position of the US in relation to the South East Asian

economies.

Slide 46

Slide 47

The third Asian financial crisis

From the analysis of the first two Asian

financial crises it becomes clear what are the competitive

tactics of the US in the ‘third Asian financial crisis’ – that is the

present one. It is to try to force China to raise the exchange rate of the RMB

significantly, at a faster rate than can be sustained by the increasing competivity of China’sa economy,

and to force down China’s investment rate. This is the combination which

defeated Japan and it is therefore the one the US can utilise in competition

with China.

However the consequences of a slowdown of

China’s economy would be far more serious than those of Japan. Japan was, and

is, a developed economy. Japan may have lost its earlier economic dynamism but

the standard of living of its population remains among the highest in the

world. China, however, is still a developing country. It has only just lifted

620 million people out of absolute poverty. Its GDP per capita, even expressed

in realistic Parity Purchasing Powers, is only one eighth that of the US – and

at official exchange rates it is only one twelfth. For China’s economy to

significantly slowdown means not to achieve a decent standard of living for

more than one billion people.

Of course, actually, this is the

inescapable logic of any attempt of the United States to prevent China becoming

the largest economy in the world - and the same will apply to India later in

this century. The population of China is four times that of the United States.

An attempt by the US to remain the largest economy in the world, rather than

China, simply means that the GDP per capita, and the living standard, of China

must never be allowed to reach even a quarter of that of the US. The same

arithmetic in the future will apply to India.

The US is the third most populous country

in the world - with slightly over 300 million inhabitants. This ensures that

the US will always be one of the most important countries in the world. If

‘economic democracy’ operated, that is there were equal GDP per capita, the US

would be the world’s third largest economy (Britain’s would be 22nd).

On that basis towards the end of the 21st century the largest

economy in the world would be India – because India will overtake China before

2030 in terms of total population. Indeed, if it had not been for the British

partition of India, India would already be the most populous country in the

world as the inhabitants of the Indian subcontinent already exceed those of

China.

An attempt by the US to remain the

largest economy in the world is simply the demand that a citizen of India or a

citizen of China never have even one quarter the living standards of a citizen

of the US. As such a policy not only is unjust and immoral but also has no

practical chance whatever of succeeding inevitably in the course of this

century the US will lose its position as the world’s largest economy.

RMB

exchange rate

In looking at these two competitive

tactics of the US first the question of an increase in the exchange rate of the

RMB will be considered. Some of the issues involved may appear rather technical

but as the question is of great importance for the world economy it is

necessary to go into it in some detail.

What

would be the consequences of RMB revaluation?

The first point, as already noted, is

that the forty year increase in the exchange rate of the yen achieved no

reduction in Japan’s trade surplus at all – as a percentage of Japan’s GDP it

is the same as it was in 1971.

Second, the question of the effect of an

RMB revaluation is not a purely theoretical one. It can be studied as a

practical issue. And the outcome of that test is very clear.

The exchange rate of the RMB did actually

go up for almost 4 years – between 2005 and 2008. This may be seen on Slides 39

and 40 as the short (red) line in the left hand corner that rises in a smooth

curve – the line is short because the increase in the exchange rate of the RMB

started only five years ago whereas it commenced almost 40 years ago for Japan

and Germany.

The RMB’s exchange rate increased between

2005 and 2008 in a far more controlled way than the yen or the D-mark

after 1971. Nevertheless after five years the increase in the exchange rate of

the RMB against the dollar, roughly 20%, is the same as in the initial five

year period of the rise in the exchange rate of the yen – although less than

the revaluation of the D-Mark in the same time period.

Therefore, by historical standards, the increase in the exchange rate of the

RMB is already rather significant. It remains to be seen whether China will

permit, or will be pressured, to allow further increases in the exchange rate

of the RMB on the scale, and with the same effect, as those which so

drastically slowed down Japan’s economy after the beginning of the 1970s.

What was occurring at the same time in

terms of China’s trade surplus as his RMB revaluation occurred is shown in

Slide 48 - which shows China’s monthly trade surplus in dollars. As may be

seen, until 2004 China did not run a significant trade surplus. A large trade

surplus began to appear only in 2005.

Slide 48

However, 2005 was the year when the RMB’s

exchange rate started to go up against the dollar. As may be seen from

Slide 49, as the RMB’s exchange rate went up China’s trade surplus actually increased

for a three year period – and as the final year, 2008, was that of the outbreak

financial crisis it is not clear if the marginal decline in that year was due

to this latter factor. The pattern is clear – an increase in the RMB’s exchange

rate led to an increase in China’s trade surplus and not a decrease over

at least a three year period.

To make that trend clear Slide 49 shows

change in the exchange rate of the RMB and China’s trade surplus over the

period since 1994. The fact that as the RMBs exchange rate went up China’s

trade surplus increased is evident.

Slide 49

In order to be able to interpret what

this trend of a rising exchange rate being associated with a rising trade

surplus signified, Slide 50 shows China’s exports and imports as a percentage of GDP. As may be

seen, until 2004 the value of both China's exports and imports rose rapidly as

a percentage of GDP. However from 2005 onwards, while China's exports continued

to rise its imports began to fall relatively in value. It was this combination

that created the trade surplus. Factually, therefore, China's surplus was

not caused by a surge of exports but by a relative fall in the value of imports.

Slide 50

It is easy to account for this

development of a rising exchange rate leading to an expanding trade surplus.

And it explains why there could be some very unpleasant trade surprises for the

world economy, in at least the short and medium term, if China were to raise

the RMB's exchange rate.

The hidden, implicit, assumption of those

arguing that an increase in the exchange rate of the RMB would lead to a fall

in China's trade surplus is that China's exports and imports move separately

and are price sensitive – in formal economic terms that demand for them is

independent and elastic. If these assumptions were factually true then, as the

price of China's exports rose, due to an increase in the RMB's exchange rate,

demand for China's exports would fall substantially while simultaneously as the

price of China's imports fell, due to the same exchange rate shift, demand for

imports would rise. But this combination necessarily assumes that the volumes

of China's exports and imports move separately – as the relative volume of

exports would in that case be falling and the relative volume of imports

rising.

The problem is that the facts indicate

that this assumption is false. An increase in the RMB's exchange rate in

2004-2008 did not lead to a major decline in China's exports but it did lead to

a sharp fall in the value of China's imports.

The factual pattern after 2004 is easily

explained if the truth is the opposite of the hidden assumption of President

Obama's advisers and others advocating RMB revaluation. That is, if China's

exports and imports do not move separately. In that case, as RMB revaluation

would increase the price of China's exports, while decreasing the relative

price of its imports, an increase in the exchange rate of the RMB will increase

China's trade surplus, in at least the short and medium term, and not reduce it

– exactly the pattern seen after the RMB’s exchange rate started to go up in

2005.

It is rather easy to see why China's

exports and imports do not move independently. China is the world's largest

exporter. A vast amount of its imports are inputs to its export industries.

Therefore demand for exports and imports are not separate but move in parallel.

Consequently, RMB revaluation puts up the price of China's exports while

reducing the relative price of its imports – therefore China's trade gap increased

as the RMB exchange rate went up, explaining the post-2004 pattern.

This may be confirmed by looking at the

volume measures of China’s trade. These show that between 2004 and 2008 the

volume of China’s exports and imports increased by almost exactly the same

percentage. But because the increase in the exchange rate of the RMB put up the

relative price of exports, while reducing the relative price of imports, the

effect of the parallel movements in volume terms of China’s exports and imports

was to increase China’s trade surplus.

The US administration’s argument that an

increase in the exchange rate of the RMB of any reasonable magnitude would

reduce China’s trade surplus, at least over a short to medium time frame, which

is the one that is important for dealing with the financial crisis, is

therefore wrong.

What conclusions can we draw from this

for the health of the rest of the world’s economy? If the factual trends in

China's trade are considered, the consequences of RMB revaluation against the

dollar could be very unpleasant for the rest of the world in at least the short

and medium term. It may be assumed that increasing prices, due to RMB

revaluation, would slow demand for China's exports somewhat, if not a great

deal, and that China's demand for imports would slow in parallel. China's trade

surplus would again rise, primarily due to the falling value of China's

imports. Overall, this would reduce the beneficial, "locomotive"

effect that the relative increase in China's imports has had on a series of

countries during the financial crisis.

That a rise in China's export prices

relative to its import prices would be adverse for major commodity suppliers,

such as Australia or Brazil, is unsurprising. But the trade data shows the

effect would spread far more widely internationally.

The US administration’s arguments for an

increase in the exchange rate of the RMB are therefore not valid. The would slow down China’s economy, to the competitive

advantage of the US, but damage not only China’s but the world’s economy in its

recovery from the financial crisis.

Exchange rate policies of China

and Russia

China has so far resisted the pressure of

the United States to excessively, or too rapidly, put up the exchange rate of

the RMB. Over the long run the exchange rate of the RMB will, of course, go up

in parallel with the increasing productivity of China’s economy. But the

Chinese government has resisted any premature or excessive increase in the

exchange rate of the RMB.

Here, if I may again make an aside, the

exchange rate policy of China has been more sensible than the exchange rate

policy of the Russian government. The purpose of China having a relatively low

exchange rate is not to run a big trade surplus. Indeed a very large

trade surplus has produced a negative consequence for China’s economic policy

in that it has led to the accumulation of very large reserves in US dollars -

which over the long term, as the RMB’s exchange rate goes up, will devalue with

considerable losses for China. China’s economy grew just as rapidly as

currently prior to 2005 when, as analysed, China did not run a trade surplus.

What a relatively low exchange rate does

achieve, however, is a high proportion of exports in China’s GDP – which prior

to 2004 was matched by a similarly high level of imports. This means that

China’s economy was participating to a high degree in the (international)

division of labour, which as we have seen is the most powerful of all

instruments for raising growth and productivity - and as part of this China was

achieving economies of scale through selling into a world market.

The Russian government, however, has

usually aimed at a relatively higher exchange rate than could have been

achieved – it rejected a policy of seeking to attain the lowest possible

exchange rate that could be practically achieved. Such a policy is supported

even by some Russian economists who I know well and deeply respect. This is a

mistaken policy. Any unnecessarily high exchange rate means that almost no

sector of the Russian economy, except for energy and raw materials, is

internationally competitive.

There is an acute objective problem for

Russia that, as a large oil producer and exporter, it has a structural bias

towards a high exchange rate - with all the competitive problems this produces

for other economic sectors. Far from seeking to maintain a high exchange rate

Russia should strategically be seeking every possible opportunity to lower it

to increase the competivity of the maximum possible

number of economic sectors.

China’s policy understood the question of

maintaining a sufficiently low exchange rate that a wide range of economic

sectors could export. Linked to this, China’s economic policy also used its

financial resources to invest in its own domestic economy via the state – in

infrastructure programmes which greatly raise the productivity of its economy.

I do not know how many people in this

room have been to Beijing, Shanghai or other Chinese cities. But apart from the

wonderful metro in Moscow the level of investment in Moscow and in other

Russian cities does not even remotely compare to the level of investment in

infrastructure and the technological processes that are taking place in China.

And the reason for this is that China’s policy does not rely just on the market

to achieve investment. It also uses state resources – as was analysed earlier.

Reduction in the level of

investment

The second competitive aim of the US is

to persuade, or pressure, China to lower its level of investment. The reason

for this, as already noted, is because investment, after participation in the

division of labour, is the most powerful instrument of economic growth. If the

US can persuade, or pressure China into reducing its investment rate, as it did

with Japan after 1973 or the South East Asian economies after 1997, then

China’s economy will no longer be able to grow at its previous fast rate.

This desire of sections of the US to reduce

China’s investment rate can even take slightly humorous or bizarre forms. There was

an article in the Wall Street Journal, an impeccably business paper,

arguing we need more ‘leftists’ in China. It called for the formation of

leftist and militant trade unions in China that would drive up the level of

consumption (and therefore lead to a fall in investment). However it may be

taken for granted that the printing of such an article was more to do with a

competitive desire to slow China’s economy than to promote left wing trade

unionism on an international scale!

There should be no misunderstanding on

the issue of consumption and investment. The only purpose of economic growth in

the long run is to promote the sustainable consumption of the population. At present

China needs to increase its domestic demand – which means stimulating both

domestic investment and domestic consumption. Strategically Chinese economic

policy, like that of every country, should be aiming at the highest possible

sustainable rate of growth of consumption of its population. But the best way

to achieve that is through rapid growth of China’s economy, not via a one off

lurch into consumption that would drastically reduce the rate of investment and

thereby slow the rate of growth of its economy.

The scale of challenge that the US faces

in attempting to get China to lower its level of investment was already shown

in graphs on the comparative rates of investment in different countries given

earlier. To make it clearer Slide 51 shows the rate of investment in GDP for

China.

To remind us how decisive the level of

investment is for growth Slide 31 earlier showed the much higher rates of

investment in China and India, the world’s second most rapidly growing economy,

compared to the US. Slide 52 shows the dramatic rate of increase in economic

growth in India associated with its rising investment rate.

Slide 51

Slide 52

Why has China’s economy continued

to grow more rapidly than India’s?

Again, as an aside, the reason that

China’s economy grows at about 1.5%-2.0% a year more rapidly than India’s is

evident. It was already noted that both India and China have a very efficient

use of investment from the point of view of economic growth – their ICOR was

almost the same at 3.7. China however invests about 6-7% of GDP more than India

and therefore its economy grows at about 1.5%-2.0% a year more rapidly than

India. It will be seen in the future whether India raises its investment rate

further and therefore grows more rapidly.

China’s increase in domestic

demand

There are many other issues I could

discuss if there were time. A notable one would be the way in which China’s

policy makers succeeded in 2009 in shifting the expansion of its economy into

domestically driven demand. In 2009 the $100 billion decline in China’s trade

surplus meant that its fall in net exports was equivalent to a 3.9% decline in

GDP – although the $100 billion increase in demand transmitted to the rest of

the world was in significant part responsible for Asia’s more rapid economic

recovery than the rest of the world. However an increase in China’s domestic

investment equivalent to an 8.0% GDP growth, and an increase in domestic

consumption equivalent to a 4.6% GDP growth, meant that China’s domestic demand

increased by 12.6% in real terms. China’s 8.7% GDP growth was therefore

composed of minus 3.9% of GDP contraction of the external sector and plus 12.6%

GDP growth for the domestic sector – one of the highest increases in domestic

demand ever achieved by any country in history. However I believe the main

strategic features of the situation have been dealt with.

In conclusion

Finally, if I may conclude on a personal

note, I remember the years I spent in 1992-2000 in Russia with great pleasure

in one sense. I learnt the great warmth of Russian hospitality and learnt to

appreciate even more than I had previously the greatness of Russian culture. I

made friends who have endured for almost 20 years. But, on the objective front,

unfortunately the great economic disaster that is was possible to foresee in

advance occurred. On this field it is far more gratifying to see in China

tremendous success, the rebuilding of a great state, the national pride it

creates, and the improvement of the living conditions of the people every year.

These differences between the outcomes in

China and Russia did not happen by accident. They were possible to foresee in

advance – because, as we have noted, they were seen in advance.

Evidently Russia cannot mechanically

follow China’s policies – I have already outlined why no country can

mechanically follow the policies of any other country. ‘Russian

characteristics’ are just as real as ‘Chinese characteristics’.

China makes no attempt to spread its

economic ‘model’. China is concerned with its own development. However anyone

is free to learn lessons from the Chinese economy. In 1992 Russia failed to do

so – the result was a great economic and historic catastrophe. Hopefully, 18

years later, the economic facts now speak for themselves. I hope that at

present many people in Russia are studying what happened in China because, as I

tried to explain, it is no accident that in the intervening years China has had

the world’s most rapidly growing and successful economy, and no accident that

is has come through the financial crisis more successfully than any other country.

China recreated a great and powerful

state and simultaneously achieved a constant increase in the living standards

of its population. I hope now, as I did in 1992, that Russia will achieve the

same.

Thank you very much for the invitation to

speak.

Sergey Kurginyan: I’d like to thank John for a magnificent lecture and to give a short

response to it. My remarks will be divided into three parts: The purely

economic (I don’t consider myself to be a specialist in this field and

apologize in advance for any inaccuracies on my part); the political-economic

and the social-economic; and those that take us on to politics as such (we will

pay most of our attention to this sphere).

I will begin by providing certain statistics and, having admitted the

approximate nature of those statistics, presenting those gathered here with my

rough evaluation of what has happened in China and my account of what, in

short, the "Chinese miracle," which is by no means accidental, amounts to.

I would like to stress again that my figures are very approximate. I

could make them more precise, but I don’t want to. I think that in this

instance it doesn’t make any difference, as the figures here are inclined to

operate as metaphors, rather than as solid, literal facts. Nevertheless, I

would like a certain pattern within the boundaries of those figures to be

maintained and taken into account.

The first point in the great Chinese plan: "What have we got? What can

we sell the world? What is our proposition? We’re selling 300 million workers

of a reasonable quality. We haven’t got anything else. But we do have workers.

So, we’re selling 300 million workers."

The next point in this plan of genius: "At what price? At a price –

the figures here are mine and are merely for reference – of 300 US dollars a

month or 3,600 USD a year." The real figures could be doubled, or indeed

halved. It is the scheme here that is important.

The third point in the plan: "We’re offering this work force in place

of western workers, who – and again this is an approximation – want 36,000 USD

a year, or roughly 3,000 USD a month."

The fourth point: "In this situation, the net profit in replacing one

western worker with one Chinese worker amounts to 30,000 USD a year.

About a third of that profit has to be spent on damping, which is to

say the lowering of prices of the goods produced by the worker to a level where

the goods will be in demand on the world market.

That leaves 20,000 USD from the replacement of one western worker with

a Chinese worker.

That amount can be split in two between us, the masters of the 300

million workers, and those who support our project, giving us a place on the

world market or helping us with investment. We shall call ourselves China, and

those who help us the pro-Chinese West.

The pro-Chinese West must bring us money and technology, and it must

open up to us the western market, which is by no means as closed as it may

appear, and create certain infrastructural elements for us.

In return, the pro-Chinese West receives half the profits created by

replacing an expensive non-Chinese worker with a cheap Chinese worker. We, the

Chinese state, also receive our half of the receipts from that exchange.

What does that half amount to if we use my admittedly very approximate

figures?

Half of 20,000 USD amounts to 10,000 USD a year.

If we multiply 300 million Chinese workers by 10,000 USD, we get a

total of 300 trillion dollars.

That, as a very rough calculation, done without going into details,

without nuances relating to infrastructure, investments, rhythms, balances and

much more besides being taken into account, is the model for the "Chinese

miracle."

If you have a commodity like cheap labor,

and you launch that commodity on the market, then, as we they say, "resistance is futile." That is to say that there is nothing

that can stop the "Chinese miracle" within the framework of the capitalist

world economy. There is no way that you can explain to a capitalist in the West

why he should pay an American woman or a French woman (fickle, with their

unions and all sorts of limitations on the length of the working day) 36,000

USD when you can pay a Chinese woman, who will honestly and conscientiously do

far more work without a union, just 3,600 USD.

Accordingly, the western economy and indeed any economy with a high

price for the commodity that is a "work force" will lose to an economy with a

cheaper price for the same commodity.

The workers, of course, must be competitive. I love all the citizens

on the planet Earth, but I can imagine that somewhere in Central Africa there

are, say, pigmies who would work not for 300 USD a month, but for 100. But they

can’t work. Or they can’t do certain types of work.

We once went to central Egypt to study the cultural processes of

Ancient Egypt. The situation is fairly disturbed in Central Egypt, and we were

accompanied on our trip by guards with machineguns. And then, in the hotel

(there is nothing above three stars in Central Egypt) I saw a fellah making a

bed with hands worn and calloused from using hoes in the fields. I realized

that he couldn’t make a bed or wash a glass. He would never be able to do that!

He could work the soil wonderfully with a hoe, but he couldn’t do any other

kind of work.

Thus, the Chinese state spends a significant part of its profits in

ensuring that the Chinese workers put up with far more modest working

conditions than those found in the West. To this end there are social programs,

ideological programs, programs for police control and so on. In addition, there

is a deep-seated wish among the Chinese, created by their traditions, which

still exert a powerful influence, to live in their native Chinese homeland. And, in particular, to be buried in their native Chinese land.

We know that very large numbers of Chinese have dispersed around the world. But

those deep-rooted desires, which we might call, following the philosopher

Miguel de Unamuno, the Chinese intra-history (or the core of Chinese culture),

give rise to the values needed for the victory of this project, which is to say

non-material attractions. Those attractions are there. There is a mass of

non-material factors that make the "Chinese miracle" possible.

Mr. Ross has entirely confirmed my position in saying that Americans

rely upon two main factors for stopping the advance of the Chinese economy: (1)

lowering investment levels (2) activities of the unions. As soon as Chinese

workers start wanting 36,000 USD a year instead of 3,600 USD a year, it will

come to an end. But for as long as they want 3,600 instead of 36,000, the

Americans will be powerless to stop the flows of investment into China. It’s

impossible!

This is clear justification of Marx’s contention that for the right

percentage a capitalist would sell his own father. If a capitalist is told: "Go

to China, you’ll get a worker for x and you’ll make a profit!" then he will go

there! And nobody will be capable of explaining to that capitalist why he

should remain in France or in any other western country.

In these conditions, the higher the level of globalization, the faster

China will destroy western civilization. Jiang Zemin

once told a friend of mine that "We are not against globalization! We will

support globalization in every way we can!" In other words: "We will give all

our support to globalization because it’s in our interests." You want to stop

the flow of investment? How will you stop it? Within the framework of the

existing world project you won’t be able to stop it. And neither the resources

nor the energy are available for any other world project, as we have seen.

What’s more, no one knows what the alternative world project should be.

That means that the only hope is that, sooner or later, the Chinese

worker will refuse to work for 3,600 USD a year, having been tempted by the

prospect of 36,000 USD a year. Then China will stop. But, until then, it will

carry on.

But this is no longer merely an economic game. In order to prolong

this situation, a socio-cultural, an ideological, a political game is being

played.

How is it being played?

The playing of this game is made possible by one key factor: Apart

from the 300 million workers (again, I stress that this figure is merely used

for reference – there could be just 200 million) already on the market and

already functioning, there are another 500 million living on 3 dollars per

month and ready, as it were, to tear the heads off those receiving 300 USD a

month.

This fundamental factor, existing alongside cultural and other

factors, signals the following from the political-economical point of view.

There is a modernized layer of society in China (relatively modernized – for

the foreseeable future there will be no full modernization in China) that we

can term Structure (set up) No. 1. And there is the layer of traditional

Chinese society – Structure No. 2. It is only until Structure No. 1 is able to

draw its resources from Structure No. 2 does the "Chinese miracle" function.

The "economic miracle" in the USSR under Stalin operated in the same way, in

that there was a vast layer of healthy, energetic and frugal people known as

"the peasants" who could be dragged out of their traditional matrixes and

driven into the factories (with certain costs, of course, because they were not

used to industrial work).

This phenomenon is referred to with a mysterious word that our

political elite uses (despite, I have become

convinced, having absolutely no understanding of it whatsoever) with great frequency:

"Modernization."

Modernization is the technology and means for the destruction of

traditional society for the benefit of industrial society. And that is all

there is to it! I have already grown weary of asking our leadership and

political elite what kind of modernization they think is possible in Russia.

After what Peter the Great, Stalin and Lenin, and those who have now had a

third attempt have already done? Where is this traditional society that they

want to modernize? And why should the person dealt a severe blow to the head

with the sledgehammer that was Gaidar’s reforms be considered "traditional"? What is it that they want to

cure him of? From what they call "sovok"

– a residual Soviet mindset? That "sovok"

mindset has long since been entirely individualized, surviving in the towns…

Where are these remaining peasant communities?

There is no "traditional resource" remaining in Russia. Marginalized

post-Soviet groups are not traditional resources.

In China there is a "traditional resource." And that "traditional

resource" will continually feed the fires of the Chinese economy.

True, China is not self-sufficient in terms of raw materials. And if

access to those raw materials was blocked off from all sides, then there is no

way the economy could develop. That is to say that China could be destroyed if

a global raw materials war was declared on it, if a certain type of siege

warfare was waged against it. It is enough to merely imagine the scale of such

an undertaking in order to grasp how problematic this would be.

And, finally, China could be destroyed with military-political

methods.

I would like to fill out this representation with an assertion that

inspires the largest number of questions in contemporary Russia and beyond its

borders. It relates to the concept of "the entity."

It is not a question of how many muscles you’ve got, how quickly you

develop them and how big a beast you are. It is an issue of the extent to which

you are a complexly organized system.

Complex systems in principle destroy simpler systems. That is a law of

life. From that point of view, the system divides into:

- Pieces in

someone else’s game (you can be a very powerful figure, a queen on the

chessboard, but you are a piece being moved by someone else);

- Players who moves

pieces;

- The masters of

the rules of the game ("the masters of the game");

I shall illustrate this with a very simple example from our modern

history.

When Boris Yeltsin came to power, he acted in accordance with certain

rules of the game, at the foundations of which lay the laws of democracy. "Long

live the rule of law! Long live democracy! The 1991 Soviet Coup d’Etat (GKChP) is illegal: It

breaks the laws of the Constitution in introducing a state of emergency. And

it’s anti-democratic. It infringes on Russian democracy, on an elected

parliament," and so on.

When, in 1993, Yeltsin realized that if he played to rules of law and

democracy he would lose the political game, he would lose in the game of chess

as the pieces were laid out, and that Khasbulatov et al would win (law was on

the side of the Supreme Soviet, as was democracy) – what did he do?

Did he lay his queen on its side and say: "I have lost!

I, Garry Kasparov, have lost to Karpov"? …No! He

brushed the pieces aside, took the board and whacked his opponent over the head

with it. After which he reopened the board and said that from now on the game

would be played to a new set of rules.

Boris Yeltsin acted as a "master of the game."

What do we see happening in China?

The Chinese have agreed to play to rules that Marx would have

described as "the laws of capitalism," and Max Weber titled "the laws of the Moderne." Both titles have their significance and the right

to be applied. Each of the terminologies has its advantages. But whatever we

might call them, the Chinese agreed to play by them.

"Is economics capitalist? It is capitalist. What are we doing that is

illegal? The ‘workforce’ is a commodity. We put that commodity on the market in

accordance with certain rules whilst maintaining stability."

And now the Chinese, as our preceding speaker has shown, are winning

through the use of the rules of that game. They say: "That’s enough! Dear

Americans! Dear Russians! We’ve won! The game is over! Our crooked economic

indicators are on the way up! And, if you’ll forgive us, how could they not go

up? How could we not receive trillions for our cheap labor

force every year? And we’re not so stupid as to misuse those trillions. We’ll

use them the way they should be! It’s over! You have lost, dear Americans!

Submit! You have lost!"

We have no guarantees that the American subject won’t play in a manner

analogous to that adopted by Boris Yeltsin. That is to say that, sensing that

he is losing according to a certain set of rules, he

will simply try and change those global rules.

In this lies the main law: "Now we shall start playing to new rules! To rules by which we will win."

Within the confines of the global rules established today, China

cannot help but win. But that doesn’t mean that there can’t be an attempt to

change those rules of the game. Lenin-Hilferding’s

"law of inequality in development under imperialism" can be abolished; the law

of the development of the capitalist market can be abolished. To use Max

Weber’s terminology, this would mean breaking the law of the Moderne.

The Law of the Moderne is a rational

community, it’s a national state, it’s markets,

capital, values… And now that law is taken and abolished. We transfer from the

formation of the Moderne to some new formation.

In my opinion, that which we call the "global crisis" is, in fact, the

beginning of an attempt to change the rules of the game.

And, from this point of view, I simply cannot understand what it is,

in essence, that the Americans have lost. The Americans continually play the

impoverished, perishing maiden, saying: "We’re dying out! Can’t you see! We

will soon be gone!" From where, exactly, are they going?

There is a 100,000-strong contingent in Afghanistan. Are we saying

that they’re leaving Iraq? Let’s see exactly when they leave Iraq, and where

they head to!

Obama is transforming into a new Bush at a brisk pace. Because the Americans have no other game to play. The only

great strength of the American economy is to be found in its aircraft carriers

and its printing presses. The aircraft carriers support the printing press, and

the printing press transports America’s problems around the world. The formula

has been fully developed.

Has someone pushed aside this quantity of aircraft carriers? Has

anyone dared to declare to the Americans that he is now the world’s leading

military superpower? No! And if that is the case, then all the problems of the

very seriously ill American economy, the condition of which we have just heard

in John Ross’s brilliant talk, will be solved by the world.

You will pay for the problems of the American consumer. For now, for ever after. Not the American consumer. He won’t

pay for his problems! And he doesn’t want to. Because he’s

got more aircraft carriers and because he’s got the printing press. But

as soon as you remove the aircraft carriers or the printing press, the American

consumer will collapse. But no one in America will allow him to collapse!

Nobody will give this up without a war!

And here the "law of the inequality of development under capitalism"

arises. You want to change the leader? A state that is

developing faster wishes to become the leader? No problem! But first you

have to win a global war!

At the beginning of the 20th century, Germany was

developing faster than Great Britain? By 1914, the pace of development of the

German economy had overtaken that of the English economy? Yes, yes, of course!

Germany had the full right to be victorious in the world, but it had to win a

world war! It didn’t manage to win it – and that was it! It was over! Germany

collapsed, while the British Empire hung on.

Germany begins to develop again, it wants to take revenge. Well, then

it must win the Second World War! It didn’t win it. It was carved up into

pieces, and only then was its economy allowed to develop as best it could! That

was its problem. American money was there, an American mentality and the like

had already been instituted there… The country was cut off at this stage! Why?

Because it didn’t win the war!

A question arises: Is the People’s Republic of China prepared to win a

war against the USA? We all understand that, at present, China is in no

position to win such a war.

Is the USA ready to organize a direct Third World War against the

People’s Republic of China? We all understand that the USA is also not ready to

do this.

But I’m putting my bets on the specific mentality and spiritual

organization of the Anglo-Saxons who never hand over power! Never! And I do not

feel any desire to criticize this – it even engenders a certain feeling of

admiration within me. Without a fight, they won’t give up power. If the WASP

elite is replaced with some other elite (akin to what is happening at present),

then this new elite may yield! A Latin American or some other

elite. But for as long as we are talking about a

WASP elite, that power will not be given up! They would rather die!

I don’t like Alexander Zinoviev, I don’t like

his works, particularly "Homo Sovieticus," because

"Homo Sovieticus" can be paraphrased as "sovok." Nevertheless, I always liked his phrase: "The

regional (Comunist Party) committee secretary won’t

hang himself when caught in the bunker! He’s more likely to hang everyone else,

rather than hang himself!"

In the same way, in WASP USA, nobody in the bunker titled

"capitulation brought about by loss in a game being played according to certain

rules" will hang himself! They’re more likely to hang everyone else. And hanging, here, means changing the rules.

And so we will be dealing with methods in the struggle for world

leadership which will bring about a change in the rules. The methods of direct

war are no use. They are no good to China because it needs another 10-15 years

to develop its military machine, and only then will it be the equal of the USA;

and America doesn’t want war because if just 4 bombs were to fall on the USA,

that would already be an intolerable loss. That means that something else will

happen in the world. What, exactly?

The experience of the last 20 years has shown us that the U.S. has

only lost one battle: It has proven unable to hold on to the world power that

it has captured. On August 19, 1991 (in reality, even earlier), world power

fell into the hands of the Americans. And nobody objected to America becoming

the leading global superpower, or to the world becoming uni-polar.

America was to rule the world. Well, begin ruling, then!

In order to begin ruling, America needed very little. It needed a

three-million-strong land army. 400,000 in Iraq, 500,000 in Iran,

dictatorships, projects analogous to the Marshall Plan, for Iraq, for Iran, for

other countries… The garrisons of a New Rome in all the capitals of a world

empire, firing squads … A local population that would support this Pax Romana…

The Americans did nothing of the kind. The wrecking of the Ba’ath

party was a criminal mistake on the part of the Americans – a crime committed

against themselves, because they could only rule Iraq

with the aid of the Ba’ath party. Gates is now trying to resurrect something,

but it’s now impossible!

The Americans have messed up the system whereby America would have

served as the world’s gendarme. Why did they lose? Because

the American – moderately intelligent and immoderately nourished – doesn’t want

to rule the world. To be more precise, he doesn’t want to pay the price

that must be paid if you are to rule the world in the Roman way.

But nevertheless, the U.S. cannot reject hegemony. The Americans

cannot reject the formula "printing press – aircraft carriers – printing press’

(using here Marx’s extended reproduction): "commodity – money – commodity’ ").

If they do reject it, they will immediately be destroyed,

they will immediately be sent hurtling down into the abyss.

And that means it can only use the Carthaginian, Phoenician system:

"No legions, no rules. Raid, hurl missiles, hang around, and then retreat just

as fast. Turn them against one another, and so on. They will be in chaos, and

we shall reap various rewards."

If a "new world order" can’t be instituted, as the Americans

themselves said (which was very reminiscent of Hitler’s terminology), then a

"new world disorder" must be instituted. And as soon as a new world disorder

arises, everything will be decided. The only major site to which it would be

difficult to export disorder would be China. China doesn’t want that disorder

to intrude: "Disorder wants to get in here through human rights? We will

throttle those rights. It wants to get in here using Uighur separatism,

fermented on Islamic fervor? We will throttle that

too! We will crush any fresh shoots of disorder. And with the aid of that

political stability we will provide for our economic growth."

The Americans are horrified by this Chinese approach! Obama,

continually referred to as "the American Gorbachev," has come to power. I don’t

know whether or not he’s a Gorbachev; some say he’s another Kirienko,

while others believe him to be a new Carter … I don’t know! I only know one

thing: If this man gives in to the greatest temptation of modern history known

as G-2, which is to say to a bipolar world, with the Chinese making up the

opposite polarity, then in ten years time the Chinese will be masters of the

world. Because G-2 assumes that something has to be shared with the Chinese

"younger brother," and that something must be given to it in exchange for this

union!

I can tell you with full confidence that the only thing that can be

shared is us, which is to say Russia! Any G-2 is, effectively, an agreement on

the division of the Russian inheritance. It can be nothing else. Nothing else

is worthy of discussion. But any division of the Russian inheritance

presupposes a swift strengthening of China. That is why Obama is no Gorbachev,

because he will not agree to this. And if he is a Gorbachev, then we are moving

on to a new stage in the development of this tragedy.

But if he is no Gorbachev, then a question arises: What will be the

Americans’ next step? Will they adopt a strategy of chaos? Will they really opt

for thermonuclear war? Will they attempt to combine a strategy of chaos with

war? Or will they move off the global historical stage?

In my estimation, the likelihood that the Americans will leave the

historic stage voluntarily is precisely equal to zero. And that means that they

will either adopt a brutal military strategy or another strategy of chaos,

perhaps a more complex version.

In any event, however, the main challenge for America is China, as was

brilliantly demonstrated by our previous speaker.

John Ross (answers

to questions)

China’s statistics

I was asked about China’s statistics with

a claim that they were unreliable. I’m sorry but it is simply not the case that

China’s statistics are unreliable in any qualitative sense in indicating its

very rapid rate of growth. First, because they can be checked, in the case of

trade, against other countries and they correlate. Second,

because where physical as well as financial data can be measured (output of

cars, output of computers etc.) they are essentially accurate.

Third,

because to the degree there have been changes in Chinese statistics, they have

revised China’s growth rates upwards because they underestimated the degree of

development of the small service sector. So I just don’t accept China’s

statistics are qualitative unreliable. Those who claim this are simply trying

to ignore the reality of China’s tremendous economic growth.

Risk of transferring economic

issues to the military level

On

the question that Sergey Kurginyan asked about the

attempt of the US to transfer questions to the military sphere. I agree this is

a tendency. This is one of the biggest current dangers because economically the

United States is decreasing in competitiveness while militarily it remains

extremely strong. This leads to a potential temptation to try to solve economic

problems by military means – and this leads to consequences such as the war in

Iraq and attempts to station missile systems in Eastern Europe. It also

encourages unstable adventurers, such as Georgian President Saakashvili,

to engage in military actions which are aimed to bring in stronger powers.

In the case of Georgia the US, wisely,

refused to have anything to do with Saakashvili’s

military attack but he may not be the last foolhardy adventurer to engage in

actions designed to try to get wider and

stronger powers to support them and this creates a risk of miscalculation

escalating.

However in the case of China any attempt

to settle economic issues by military means, by anyone, would risk a world and/or nuclear war and

that is quite a different scale of issue to invading Iraq, military adventures

by Georgia, or missiles in Eastern Europe. The reason that the Cold War

remained cold was that no one was prepared to undertake a world war in a

nuclear era. Even if some extremist ‘neo-conservative’ circle dreamt of

resolving issues with China by means of war all other means would be tried

first.

The first hope of even the most

‘neo-conservative’ circles is that China will wreck itself – that is ‘commit

suicide’. After all this has occurred before. The Soviet Union ‘committed

suicide’ – it was not destroyed from the outside, it destroyed itself from the

inside. Japan could have attempted to resist the economic policies imposed on

it but it chose not to, so Japan also wrecked itself. Even if a US

administration at present wished to wage a war with China, which it doesn’t, it

is not is a position to – it has too many other problems at present. It is

better to hope that China would wreck itself, ‘commit suicide’.

Why does the US not raise its

rate of investment?

I was asked why the US doesn’t raise its

own level of investment in order to compete? This is

due to political reasons.

If a country wants to raise its level of

investment, and has no extra source of finance from abroad, then by simple

arithmetic it must cut its consumption. One way to achieve this would be for

the US to cut personal consumption but that would be drastically unpopular and

probably lead to the defeat of whichever party attempted it. Another would be

to reduce US military spending – which from an economic point of view is

government consumption. Over 5% of US

GDP is devoted to military spending. If that was reduced to a normal level for

other countries, say 2.5% of GDP, that would give the resources for a big

increase in investment. But it would also require a huge change in the US

foreign policy so at the moment it has not been happening. One thing that is

being protected in US federal government spending is the military budget.

As for cutting the household consumption

of the US population we have already looked at why that would be drastically

unpopular in examining the cases of Presidents Nixon and Carter. Nixon was not

forced from office simply because of the scandal of the Watergate break in and

Carter was not a fool, but a very intelligent person. But both attempted to

recreate the competitivity of the US economy by

increasing investment via reducing the consumption of the US population – which

was the accompaniment of their presiding over dollar devaluations. That is why

they were unpopular.

President Reagan’s policy was to import

the capital necessary to finance investment in the United States, while

maintaining a high level of consumption, by borrowing from the rest of the

world. And the rest of the world for a certain period was prepared to finance

this both under both Presidents Reagan and Clinton – that is why they were able

to maintain their popularity. President Obama at present is reducing US

consumption somewhat – although not as severely as Presidents Nixon or Carter.

Therefore he is becoming unpopular. The ability to raise the investment level

of the US therefore has a deep political dimension.

The RMB’s exchange rate

I was asked about the RMB’s exchange rate

and what would be a correct one? I have already dealt with the RMB’s exchange

rate at some length but the simple answer is that the right exchange rate is

one which, over a period, permits a relative balance in the trade balance.

As was analysed earlier China’s economic

policy has a great interest in having a very high level of exports because that

allows it to engage in the international division of labour and to achieve

efficiencies through economies of scale. One of the great failures of the

Soviet Union was that its leadership didn’t understand the question of

international division of labour, which is what foreign trade is, and therefore

didn’t aim at a high level of exports and imports. But China has an interest in

a high level of trade – that is one aspect of the ‘openness’ of its economy. It

has no interest as such in a large trade surplus - that’s a different thing.

There is no problem if a country has a

high level of exports provided it has a high level of imports as well. And as I

noted during most of China’s economic reform period, from 1978 to 2005, China’s

trade was more or less in balance – very high exports, very high imports. It’s

only in the last 4-5 years that a big trade surplus has developed and it is now

going down again. Strategically I think

the RMB’s exchange rate will evidently go up as the productivity of China’s

economy develops but it should be in line with that productivity increase and

not ahead of it.

Foreign investment

Coming to a question about the role of foreign

investment, or as it was slightly provocatively put of the ‘selling’ of China’s

labour to foreign companies. Most labour in China work for Chinese companies. About 5%

of China’s investment each year comes from abroad and around 4% from Hong Kong

and Macao. 91% of Chinese investment is domestic.

It is true that in the early period of

reform the role of foreign investment was greater, and foreign investment is

still very important in areas such as exports. Also foreign investment allows

the importation of advanced technology. So its real

role is certainly bigger than 5%. But it is simply not true that China’s

economy is essentially dependent on investment from abroad. And it is becoming

less and less true.

Sergey Kurginyan:

I am grateful to Mr.Ross

for the valuable addition, although as is quite obvious it does not change the

essence of the issue.

First. Mr. Ross himself is saying that all started

with the different way of participation of foreign investors in sharing of the

aggregate export product of China.

Second,

and the most important. It is irrelevant who and in what way sells the cheap

Chinese labor to the West and the world at

large. Whether Chinese or non-Chinese

companies are doing it, they are selling. They are not doing anything

different. When you lack your own spare capital to do it (that was the case at

the initial stage in China) you invite foreigners. But when your assets are

enough (China possesses enormous amounts today) why should you give away the

key part of the super-profit? You keep it to yourself.

Third,

and Mr. Ross is perfectly aware of that: the fine game is being played where

the watershed between "own capital" and "attracted capital" notions is blurred.

The "own" capital is in fact not exactly "own". The "attracted capital" is not

exactly "foreign". But these are indeed fine points.

Apologizing to Mr.Ross for this intervention

in his answers, I have to once again express my gratitude for his important

clarification. As to intervention, I

only deem it excusable because of the importance of the subject

and since, as everybody understand, the answer to some extent was addressed to me.

John Ross:

It is also very important to understand what is the real

economic process from the point of view of the standard of living. An

urban income in China is three times a rural one. A peasant

who moves to a city, whether they work for a foreign company or not, on average

triples their income. Wages in China may still appear, and are, low from

the point of view of the advanced world but anyone who triples their income is

going to see that as a huge step forward. Simultaneously they are making a

product which can be sold on the world market and it is competitive on the

world market. It is, in a phrase the Chinese authorities use, a ‘win-win’

situation. And the value added, and the wages, become higher each year.

If a person puts up their income by 300%

their immediate reaction is not going to be that they are ‘super exploited’ –

more likely they feel it is a brilliant breakthrough in life.

Of course China was only able to pursue

its economic course initially under certain conditions. One was that China

benefitted from the military protection given by the Soviet Union. Despite the

Sino-Soviet dispute, and border skirmish, China knew that the US could not

militarily launch an all out attack on it because the USSR would never have

allowed the US to exercise dominance along Russia’s long eastern border. Deng

Xiaoping was able to cut China’s military

budget, which was one of the initial ways in which funds were raised to

stimulate consumer demand and investment, in part because China was protected

from the North by the Soviet Union. Without that China would have had to

concentrate on heavy industry to build armaments to protect itself

– and on that basis it could never have had the economic success it has

achieved. The industrialisation process of the Soviet Union historically

created a protected space in which China could develop its economy.

Why can China sustain such a high

rate of investment

I was asked why China is able to achieve

such a high level of investment. The technical answer is because it has a very

high rate of savings – by definition every act of investment must be financed

by an equal act of saving. But this, of course, simply raises the question of

how can China have such a high savings level?

The answer to that does not lie in the

level of household savings. China has a much higher rate of household savings

than Europe, not to speak of the United States, but it is a lower level than

India for example. The answer lies in the extremely high levels of saving, that

is profits, by companies. China has created, strangely enough together with

France, something which had never existed in the world before - which is highly

efficient internationally competitive state owned companies. How this was

achieved, and why it was not in the USSR for example, would be the source of a

whole talk by itself so I cannot deal with it here. I will simply state it as a

fact you can verify independently. It is one of the cores of China’s ‘socialist

market economy’ and one of its consequences, as we saw, is China’s ability to

regulate its overall level of investment.

Science and technology

I was asked about the development of

science and technology in China. This is purely a question of expenditure and

time. The United States spends more than 3.5% of GDP on science and research –

it is a developed economy and can afford this. China as recently as 1995, a

much poorer country, could spend only 0.5% of its GDP on science. By 2005, the

latest date for which I have figures, that had tripled to 1.5% of GDP. This, of

course, is still far behind the US but the rising trend is clear. In some

areas, for example its high speed trains, and renewable energy, China’s technology

is now highly advanced and among the best in the world. As China’s scientists

and technologists are neither more nor less inherently talented than those of

any other country it is simply a matter of time and expenditure before the

science and technology of China is on the same level as the United States and

other countries.

The same applies to the question of the

development of the sophistication of products and creation of brands. When Japan’s companies started to export

their products in the 1950s, or South Korea’s firms did in the 1970s, they were

initially of very poor quality. Toyota’s cars in the mid-1950s drastically

overheated when used in the US and had to be withdrawn from the market. Samsung

was producing black and white televisions when that was a totally antiquated

technology. Toyota today may be having a few product difficulties but it

remains a totally world class company which defeated Ford and General Motors in

competition. Samsung has become a byword for design excellence.

The development of science and technology

is not a question of ‘individual genius’ it is just a question of time and

money – as in every country historically. It should be pointed out China’s

government fully understands the decisive role of science, technology and research

– it is emphasised in almost every major speech on the economy.

Will China wreck itself

I was asked whether China will follow the

pattern of the Soviet Union and ‘commit suicide’ - that is destroy

itself. I don’t know. That is a matter the people of China will decide not

foreigners. But I do believe the only way China can fail is if destroys itself.

The US cannot launch a war against China even if it wished – because that would

mean a world nuclear war. Not only would no one else go along with this, as

people have a strong desire to stay alive, but the calculation would have to be

that it would not be a war confined to the US and China. Japan would be

attacked. The US would have to calculate Russia might join in. Certainly the

military planning of the US and Japan would have to take into account a

simultaneous war against China and Russia. This would be utter madness and

quite impossible to undertake in the next ten to fifteen years – if ever. But

in ten to fifteen years time China’s economy can be as large as that of the US

and that will solve the military issue once and for all – for in military tests

of strength it is not GDP per capita that is decisive but the absolute size of

an economy.

So unless China wrecks itself, that is

abandons the policies which have brought it such success, the overtaking of the

US economy by first China and then India is inevitable. As I stated Goldman

Sachs calculates China’s economy will be bigger than that of the US by 2026,

and India will overtake the US around 2050. Purely mechanical extrapolation of

growth rates gives earlier dates. Evidently these dates can move around by a

few years but the trend, unless China or India commits suicide, is clear.

Historical relation of Russia and

China

Somebody asked me the question whether

the Russian and Chinese people are brothers. As I am neither Russian nor

Chinese it would be inappropriate of me to attempt to answer that question and

therefore I will not do so. But I can make a few observations on history.

A most fundamental fact of the 20th

century, as I see it, is that each time that that Russia/ the Soviet Union and

China were united they were victorious. And when they were divided one or other

lost.

Why was the Soviet Union able to win the

Great Patriotic War/the Second World War? First and foremost

of course due to the great heroism of the Soviet people and their gigantic

efforts to achieve that victory. But a precondition for victory was that

they were not simultaneously attacked from the East – by Japan.

And the reason Russia was not attacked

from the East was twofold. The first was that the Soviet Union won the military

battles against Japan in 1938 and 1939. But in 1941 Russia was engaged in a life

and death struggle to its West. If Japan had attacked the Soviet Union with the

full weight of its military forces in 1941 Russia would not have been able to

deploy sufficient forces to defeat both Nazi Germany and Japan simultaneously.

The major reason Japan did not attack Russia from its East in 1941 was that

Japan was trapped in the war in China. The resistance of China to Japan’s

invasion was hugely stronger than the latter had envisaged. The Soviet Union

was protected from its East by China.

After World War II the fact that there

was an alliance between China and the Soviet Union then, of course, aided the

creation of the People’s Republic of China – that is the establishment of a new

independent China. Because no matter how great the resistance of China to

Japan, and 30

million people died in China’s war against Japan, without the military

assistance that was given to the Chinese Communist Party (CCP) by the Soviet

Union, the CCP could not have emerged victorious and resisted the threat of

military intervention against China by the United States. General MacArthur was

prevented from using nuclear weapons against China during the Korean war by President Truman, among other reasons, because the US

feared nuclear retaliation by the USSR.

To move on, the US has only lost one war

– in Vietnam. Despite the Sino-Soviet split China never stopped the military

support that was given to Vietnam by the USSR crossing Chinese territory. It was simultaneously the

struggle waged by Vietnam and the combined forces of China and the Soviet Union

that resulted in the US defeat in Vietnam.

Then there came a great period of

division between China and Russia during which, as we may say, the Soviet Union

‘committed suicide’ – and China was left by itself.

What remains the case, and it is

something I profoundly believe in and have attempted to explain above, is that in the modern era, in an advanced economy, a

‘country-size’ economy does not work – by which I mean one on the scale of a

traditional West European nation state. Only a continental-size economy

possesses adequate division of labour, and sufficient economies of scale, to

work really efficiently.

So if I could repeat

what a Russian friend said about Russia - and I’m only repeating what a Russian

said to me. He said the break-up of the Soviet

Union has a result like a deep-sea diver who has gone down to a great depth and

has got the bends – that is the formation of gas bubbles in the blood.

When he comes to the surface, and has the bends, you don’t

not know how long it’s going to take but he is going to be paralysed or

die.

The breakup of the economic space of the

former USSR was a historical catastrophe not merely for Russia. The economic

space that was the Soviet Union was far more integrated than was the European Union

for example. It is regrettably cynical that US administrations which promoted,

for example, the economic integration of Western Europe today set as one of

their number one goals in the world preventing integration between Russia and

the Ukraine.

Russia is too small by itself to be a

truly successful economy. I’m afraid reality shows that the minimum size of a

really successful economy in the modern world is around 300-400 million people

- the smaller figure being the size of the US. A 140 million people state just

won’t do in the modern world. China is a continental scale economy. The US is a

continental scale economy. India is a continental scale economy. Western Europe

is large enough to be a continental scale economy – if it could unify itself. The

USSR was a continental scale economy. But Russia by itself cannot be a

continental scale economy. A large geographical space is not decisive. It is

the number of people and their productivity that counts.

Russia will never be allowed into

‘Western Europe’ in the real sense - and it is simply an illusion to believe it

is possible. The core of the European Union is the alliance between Germany and

France -around which is grouped Italy, Holland, Belgium, and Spain. That is 250

million people but it is the alliance of France and Germany that dominates. To

allow Russia into ‘Europe’, given the population of Russia is equal to Germany

and France combined, would be to create a Europe in which the alliance of

Germany and France could no longer dominate. And for that reason Russia will

never be allowed ‘into Europe’.

The Soviet Union was an entity large

enough to take its place alongside China and Western Europe. That is why

Vladimir Putin was right to describe the break-up of the USSR as a geopolitical

catastrophe. Today, evidently, Russia,

which has been greatly weakened by the break up of

the USSR, has an interest in good relations with both Western Europe and China.

How it will resolve the geopolitical disaster created by the break-up of the

USSR involves far wider questions than economics. But the parameters set by

economic questions I think are clear and I have tried to outline some of them.

Thank you .

Sergey Kurginyan: Wrapping up, I would like to touch on three issues.

I will begin with what Mr. John Ross has just

said. In answer to the question "What must be done for investment to flow into

America?" he replied: "Either cut consumption, or

military expenditure" (in other words, non-productive expenditure)…

I would be grateful if someone could explain to

me what doesn’t fit into the general outline that I have given here (albeit

having specified that it has been simplified for reference and so on)? If

something does not fit into the framework that I have given, then it must be

further developed, and a further complexity added on.

Again, what does the term "develop" mean here?

Developing the picture and adding in further detail by no means needs to be

carried out in economic terms or language. Economic language offers no

prospects for politics – it does not function in this sphere. Explain in

normal, simple Russian words: What makes a country attractive for investors?

Describe various scenarios for attraction…

The first level of China’s attraction, without

doubt, is its cheap labor force. But, as our

respected speaker noted, the peasants have now begun to receive more. What does

that mean? That means that gradually the traditional structure is fracturing.

And the donor is fracturing. It is this that we can identify as an element of

"the Chinese suicide."

As soon as the Chinese workers want to receive

36,000 USD instead of 3,600 USD, as soon as the lower section of the country

stops impatiently knocking at their door from below, the development will be

over. These are the two sources of linear modernizing growth.

Will more complex sources of attraction appear?

Let us describe them! While the coarser sources more or less account for the

"Chinese miracle," one does not need more refined sources. It’s the principle

of Occam’s razor: do not complicate an essence! There is no need. That is the

first point.

Secondly. Who creates a situation that causes investment

flows?

Of course, there are forces that could perhaps

regulate investment flows. I am the first to point out that there are subjects

in the process. The process does now flow of its own accord. There are masters

within it – certain people that control that process. But I have never said

that there are only masters! There are objective processes. There is an

objective name for an objective process – "attractiveness" or "maximum profit."

Investment flows to wherever it can receive a

maximum profit. And special efforts must be made in order for it to flow in the

opposite direction. In order for water to flow uphill you need hydraulic

devices, pumps and the like. And to make it flow downhill you merely need to

pour it. And it will flow.

For now, this "water" is flowing into China,

largely because the attraction indicated is present there. When – and I stress

this again! – the Chinese peasant gets comfortable,

and the Chinese worker becomes leftist and unionized, these sources of investment will come to an end.

Then, no doubt, other, more refined sources will be found. Well, we shall see.

I would like to again stress the following. China

has agreed to play by modernizing or capitalist (depending on whether you

prefer Weber or Marx) rules. It has agreed to play to the rules that the master

of the rules has proposed. And it wants to win.

I don’t believe that China will reject its

rightful win. The Chinese are a far less "warlike" people than the Vietnamese

or the Japanese. But they are not so soft that they will reject a win that they

are rightfully entitled to. We shall have to see what China will do! But China

has agreed (and it is in this (this!) that the fundamental weakness of the

great political strategist Deng Xiaoping lay) to play by the internationally

accepted rules.

The USSR refused to play by them for a certain

period of time. Yes, it collapsed. But this is not a matter of the rules

themselves coming to an end. And perhaps the destruction of the Soviet Union

came about precisely because it was frightening that the USSR had its own –

non-modernizing – project for development, that it had created its own,

alternative rules. And first those rules had to be shut off, and only then the

development as such. Otherwise you would shut off the normal development, and

everyone would go running to the Russians for their models. But now they don’t

go running to the Russians. Or that is believed to be the case.

Thirdly, there is the division of the

inheritance. Do the results of the collapse of the USSR give the USA some

opportunities or not?

Let me tell you certain things of which I’m

convinced. Over the course of the last two decades, we have managed to hang on

to Siberia only thanks to the Pentagon’s fear that the Chinese would take it.